Cryptocurrency money have two distinct kinds of investment: long haul and the short. Without broad direction, the two types of interest appear to be substantial right now, and in light of the fact that the innovation behind digital currency is so unpredictable, it can be difficult to anticipate which organizations will be the victors and failures in creating vigorous and adaptable stages.

A great many people have not completely grasped the genuine potential for advanced resources and their utility for innovation and business. In spite of being around for almost 10 years, the whole idea driving them is new, and most cryptographic forms of money beside Bitcoin are just a couple of years old, as Ethereum or Ripple.

A few people are frightened of this new innovation, while others are energized and partaking early. The individuals who are taking part fall into two unmistakable classes: long haul, and afterward the “pump and dump”.

Long haul members are comprised of clients who trust in the vision of the computerized resource, its utility, and application. When taking a gander at crypto resources for take part in long haul, it is essential to do your own due perseverance. Be that as it may, here are a couple of inquiries to thoroughly consider.

Is the crypto organization resource in light of a smart thought? Is it taking care of a genuine issue or simply set up to be tradeable token?

Is there a dynamic group to help this crypto resource?

What kind of innovation is behind it? Is it legitimate tech?

What is the potential estimation of this plan to the market?

Above all, does the TEAM have an earlier reputation of accomplishment?

In the event that a crypto resource reacts emphatically to these criteria, it will have a substantially higher possibility of upside and esteem creation over the long haul, as its utility is valued, and the market responds to its prosperity. All things considered, assorted variety is vital. Diverse cryptographic forms of money remove every single day. The digital money industry is past eccentric. Staying with only one part of it accompanies its own particular dangers.

Lydian is one utility token that is searching for long haul cooperation with a creative and brassy technique. Lydian’s innovation will keep running on The Whisper Network, which is meaning to fathom the versatility issues that torment current blockchain innovation. Lydian will likely rethink the advanced promoting biological community by concentrating on a client driven advertisement encounter through manmade brainpower.

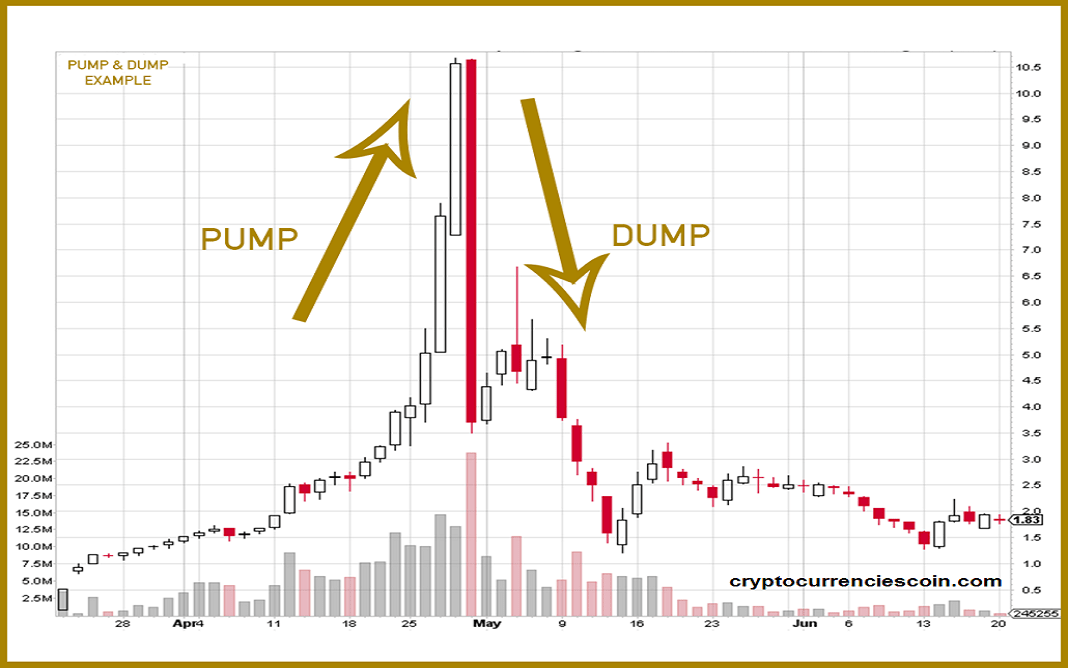

While Lydian might be a perfect possibility for long haul investment, there are other crypto resources that crypto-fans pump and dump day by day for a brisk benefit. Put basically; these are gatherings of examiners who toss a lot of cash at littler digital currencies to raise their esteem. The goal is that the overall population sees this esteem rising and begin taking part also.

Pump and dumps are controlled by gatherings of individuals on stages like Facebook, Discord, or Telegram. Some require an up front investment, implying that the gathering pioneers profit regardless. Any individual who isn’t a pioneer is basically betting their cash in.

The higher one “positions” in a gathering, the prior they get the message impact to offer. These cautions are sent seconds separated. While that doesn’t seem like a huge amount of time, a half-second has a gigantic effect in the event that one wins or loses cash.

Pumpers additionally advance the cryptographic money on their online networking, additionally bringing issues to light to whatever is left of the world. At that point, once the digital money hits a foreordained esteem, everybody “dumps” or offers the advantage as quickly as time permits for benefit. Giving the retailers the shaft.

We emphatically trust this is the place direction needs to come in. It is basic for everybody to do clever research before putting their benefits into anything. In this way, kindly do your due determination and don’t fall into a crypto trap. We see the pump and dumpers equation ethically dishonest. You can contrast it with Jordan Belfort, broadly known for Wolf of Wall Street, or a Ponzi-plot like Bernie Madoff. It’s simply wrong or savvy.